Table-12 of GSTR-1: New Changes Effective April 2025

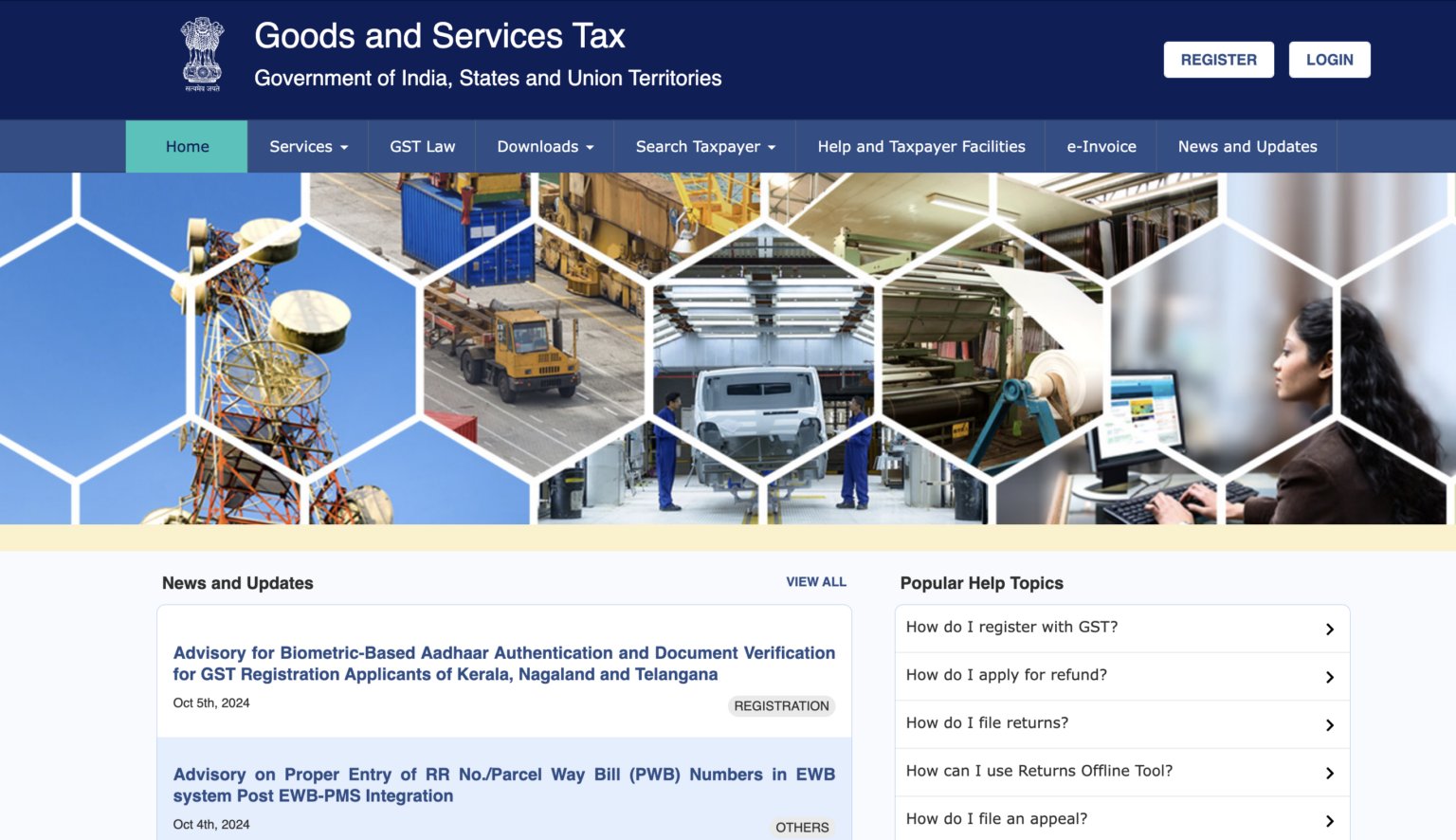

Introduction The Goods and Services Tax (GST) system is continuously evolving to improve accuracy, transparency, and efficiency in tax filing. As part of the Phase-III

Introduction The Goods and Services Tax (GST) system is continuously evolving to improve accuracy, transparency, and efficiency in tax filing. As part of the Phase-III

Introduction In a significant move aimed at enhancing GST compliance and removing data duplication errors, the Goods and Services Tax Network (GSTN) has issued a

Introduction Bookkeeping forms the cornerstone of efficient financial management in any business. It involves the meticulous documentation, categorization, and reconciliation of all financial transactions that

Introduction As India’s tax system continues to evolve, a key decision for taxpayers in 2025 is choosing between the old tax regime and the new

Introduction In today’s rapidly digitizing economy, the traditional methods of invoicing and taxation are being replaced by faster, smarter, and more automated digital solutions. Among

Introduction Did you know that by 2025, over 90% of businesses will rely on e-invoicing for GST compliance? With rapid advancements in AI-driven automation, blockchain

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, contributing significantly to employment and GDP growth. However, when disputes arise, particularly under

Introduction Starting April 1, 2025, businesses registered under the Goods and Services Tax (GST) regime in India must comply with a new 30-day e-invoice rule,

Introduction In a significant ruling, the Income Tax Appellate Tribunal (ITAT), Delhi Bench, has held that no penalty under Section 270A of the Income Tax

Introduction From July 1, 2024, partnership firms and LLPs must deduct TDS on payments to partners under the newly introduced Section 194T. This new provision,

Introduction A recent survey conducted by the Indian Council for Research on International Economic Relations (ICRIER) reveals a significant shift in how Micro, Small, and

Introduction A recent report by the Public Accounts Committee (PAC) has put the spotlight on the difficulties faced by Micro, Small, and Medium Enterprises (MSMEs)

Introduction In a noteworthy move aimed at easing the tax compliance burden and encouraging the settlement of past disputes, the Central Board of Indirect Taxes

Introduction In a significant move to ensure financial discipline and timely payments to Micro and Small Enterprises (MSEs), the Ministry of Micro, Small and Medium

Introduction TDS (Tax Deducted at Source) is a well-known concept under the Income Tax Act, but it also plays a significant role in GST compliance.

Introduction India’s Goods and Services Tax (GST) system has introduced various measures to ease tax compliance for small businesses. One of the most beneficial provisions

Introduction As businesses strive to stay GST-compliant, one common stumbling block has been the correct filing of forms SPL-01 and SPL-02—especially under the GST Amnesty

Introduction Expanding your business to multiple locations? Ensure smooth operations and compliance by updating your GST registration for each site. If you fail to update

Introduction The introduction of GST has brought many benefits to both consumers and the government by streamlining the indirect tax system in India. The significant

The GST laws have brought transparency and integrity to India’s indirect tax system. The government has introduced various amendments to ease compliance while making regulations

Introduction The latest CGST rules mandate every transporter to carry e-way bills while transporting goods from one place to another if the overall value exceeds

Input tax credit is an essential component of GST, which eliminates the cascading effect of taxes and brings transparency and efficiency to the indirect tax

The GST Council is reportedly considering a reduction in the Goods and Services Tax (GST) on health and life insurance policies from the current 18%

Navigating the realm of Goods and Services Tax (GST) registration can be a crucial stepping stone for small businesses looking to establish compliance with tax

In the realm of taxation and business operations, the Goods and Services Tax (GST) number plays a pivotal role in the regulatory landscape. This unique

The GST Composite Taxpayer Scheme is a game-changer for small businesses and startups in India, offering a simplified tax compliance framework. With cost-saving benefits, streamlined

Introduction As the financial year draws to a close, managing your taxes effectively can lead to significant savings. Here’s a guide on how to minimize

Introduction As the financial year 2024-25 draws to a close, businesses across India must gear up for the crucial task of GST compliance. Adhering to

TDS Changes Effective from 1st April 2025: Key Updates for Taxpayers Starting from April 1, 2025, several changes to the Tax Deducted at Source (TDS)

In a significant financial development, the latest data from the Income Tax Department reveals that over 4.68 lakh taxpayers in India declared an annual income

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, contributing significantly to employment, GDP, and exports. In a recent announcement, the government

Introduction GST registration is crucial for businesses as it allows them to operate legally, collect GST from customers, and claim Input Tax Credit (ITC). However,

The process of Goods and Services Tax (GST) registration is a fundamental requirement for businesses operating in many countries worldwide. Understanding the nuances of GST

Navigating the intricacies of Goods and Services Tax (GST) registration can be a significant milestone for small businesses looking to establish their legal presence in

When starting a business or reaching the threshold for Goods and Services Tax (GST) registration, accurate completion of the GST registration form is crucial. Understanding

For startups venturing into the business world, understanding and complying with taxation regulations is crucial for sustainable growth. Goods and Services Tax (GST) registration is

The process of Goods and Services Tax (GST) registration is a crucial step for small businesses operating in India. Understanding the fundamentals of GST registration,

The growth rate of e-way bill generation in India slowed to 14.7% in February, according to the latest data from the Goods and Services Tax

Navigating the realm of Goods and Services Tax (GST) as a casual taxpayer introduces unique considerations and responsibilities. Understanding the invoicing and payment requirements is

Public sector banks in India are increasingly collaborating with fintech companies to enhance the accessibility and efficiency of MSME (Micro, Small, and Medium Enterprises) lending.

Introduction With the rapid digitalization of industries, computer education has become a necessity. As a result, investing in a computer institute franchise is a lucrative

Introduction: The Union Budget 2025, delivered by Finance Minister Nirmala Sitharaman, introduces game-changing measures to foster growth and stability in India’s Micro, Small, and Medium

Franchises offer businesses a wide range of opportunities. They provide extensive, affordable, and profitable opportunities, thereby determining their growth. In the Indian healthcare sector, Dr

FirstCry is an e-commerce company registered in the year 2010 in India by two people namely Supam Maheshwari and Amitava Saha. This firm specifically sells

The E-Way Bill system is an essential component of India’s Goods and Services Tax (GST) framework, introduced to regulate the transportation of goods and ensure

Introduction to GSTR-3B The GSTR-3B is a summary return of supplies made within a tax period along with the GST payable, which is an essential

If you are from the optical care industry, the Lenskart franchise would really be a great investment to make. As the leading eyewear company in

In a recent announcement, the Central Board of Indirect Taxes and Customs (CBIC) extended the deadlines for filing GSTR-1 and GSTR-3B returns due to significant

Do you want to become your boss but do not have enough cost for the setup? That can surely be annoying. In fact, you’re not

As a business operating in India, you must be GST compliant. Not following the compliance rules can sometimes get you in trouble especially for the

Every small business once wants to go for a franchise, considering the great growth opportunity it offers. With franchises, it becomes easier to become recognised

Billing is an important part of having a franchise business because it makes sure that things and services are exchanged for money. However, it can

Introduction As businesses across India continue to evolve in 2025, one aspect that remains critical for franchise owners is GST compliance. The Goods and Services

Second-hand products, from cars to furniture, from electronics to clothing, have a significant position in today’s busy marketplace. The appeal of affordability and the aim

Co-working spaces have transformed how organisations function, providing flexible and collaborative workplaces for start-ups, freelancers, and large enterprises. However, this dynamic company model entails the

Seasonal businesses operate in a world of fluctuating demands and revenues, often dictated by external factors like holidays, weather, or specific market trends. This variability

As an influencer in India, 2025 is shaping up to be a game-changing year, with more opportunities to earn online than ever before. From sponsored

Small and medium-sized businesses (SMEs) must contend with a changing environment of digital transformation and regulatory compliance as 2025 approaches. Businesses frequently encounter difficulties due

India’s Goods and Services Tax (GST) revolutionised how businesses handle taxation, and now, as the nation braces for GST 2.0 in 2025 significant changes are

The retail market has shifted dramatically in recent years. As we approach 2025 you will agree that shopkeepers are more than just business owners; they

India’s Goods and Services Tax (GST) regime has been instrumental in streamlining indirect taxation, fostering a unified market, and promoting economic growth. However, new challenges

Consider a world in which all financial transactions are traceable, transparent, and tamperproof. Tax evasion, which has long been a problem for countries around the

Navigating the complexities of tax compliance is an essential part of managing a business, particularly for exporters. In India, the tax system has become more

As businesses continue to navigate the complexities of GST compliance, a significant change is on the horizon, we will keep you updated with latest GST

With the rapid inclusion of digital payment through UPI, MPIN is probably the most used number code right now in India. PhonePe with 48% and

Marketing has rapidly evolved in the past few years. Businesses have devised different solutions and new ideas to venture into the market and bring disruptions.

In the current digital environment, engaging customers through their preferred communication channels has become crucial. It offers an effective way of building long-lasting customer relationships.

The Goods and Services Tax (GST) is integral to India’s tax system because it ensures all states’ taxes are identical. Following the rules, you could

Starting a franchise business can seem to be a lucrative opportunity. You’re already getting the benefit of starting your business with someone established. Therefore, as

Indian franchising has grown a lot in the last ten years. It is easy to see why Indian franchises are so in demand, with businesses

Customer communication has changed in the digital age, and WhatsApp is now a vital tool for companies looking to interact with their target markets. With

The majority of India’s population resides in rural areas and small towns. With many businesses relying on the agricultural sector, there are numerous opportunities to

Do you own property in the prime areas of your city? Are you hoping to generate income from it without the hassle of starting your

India’s business landscape has transformed significantly in recent years. From ranking 142nd in 2014 on the World Bank’s Ease of Doing Business Index, the country

India is leading the way in renewable energy, with solar power taking the top spot. Due to abundant sunlight throughout the year, solar panels are

India’s food and beverage sector has expanded significantly in the last several years. A growing middle class, an expanding population, and people with more discretionary

Many people dream of becoming entrepreneurs, but starting a business often feels like a huge financial challenge. Some prefer something simple, while others think about

The healthcare industry offers many great opportunities for those looking to start their own business. There are various types of healthcare franchises to choose from,

For many years, franchising has been a successful business strategy that appeals to both seasoned business owners and newcomers. It gives franchisors a means of

Startups that qualify can get tax breaks through the Startup India Action Plan. Some of these are tax breaks on profits for up to seven

A drug license in India is a formal permission from the government given to a business. It is for everyone in India who makes, sells,

Managing a variety of product categories, making sure that customer checkouts move smoothly, monitoring inventory, and adhering to GST requirements are just a few of

Running a supermarket involves juggling multiple tasks i.e. managing inventory, ensuring accurate billing, handling offers, and maintaining GST compliance. With the complexity of daily operations,

Running a clothing or fabric store is not an easy task in India. The process might easily become too much to handle when one has

It may surprise you to learn that handling GST-compliant invoices might be similar to traversing a maze. You will have to deal with fines, inaccurate

Wholesale businesses operate in a fast-paced environment where managing large-scale inventory and bulk transactions is daily challenge. GST e-invoicing, introduced as part of India’s Goods

Inventory management is the backbone of any business, whether you are running a bustling retail store, a manufacturing unit, or an e-commerce warehouse. Yet, ensuring

In the ever-demanding world of healthcare, staying on top of payments is not just about balancing your books, its also about ensuring your practice runs

Introduction Imagine running a business where invoicing feels like a breeze all your payments rolling on time and your focus shifts from chasing overdue bills

In the world of business, billing isn’t just an administrative task but it’s also a crucial communication channel that defines how customers perceive brand’s professionalism,

When establishing a business, it is important to identify your business model and establish the right touchpoints. Identifying the typical customer journey for both the

Non-compliance in businesses can cost an average of $4,005,116 loss in revenue. Would you like your business to suffer such a big loss? Compliance training

Employee experience platforms apply technology in HR to help transform the workplace by improving communication, enhancing employee productivity and engagement, personalizing the employee experience, promoting

Green cloud computing is a significant advancement in environmental responsibility and technology. Businesses today can achieve substantial growth without the huge environmental effect often associated

Customer service has a special role in business-to-business (B2B) interactions, where corporations sell goods or services to other businesses instead of individual consumers. B2B customer

The adoption of cloud software has transformed the way businesses do operate by offering flexibility, cost-efficiency and scalability. However, despite of its widespread adoption, cloud

“The customer experience is the next competitive battleground.” In the digital age, offering outstanding customer service is no longer an option; it is a must.

Managing invoices manually can be a headache—especially when you add GST compliance into the mix. With numbers to track, taxes to calculate, and deadlines to

Do you Run a restaurant? Then you are already aware of it’s high-stressed, fast-paced environment where every second counts. From getting orders right to ensuring

Running a jewellery business is no small feat. Between keeping track of precious stock, managing customer orders, and making sure every transaction is accurate, it’s

© Copyright CaptainBiz. All Rights Reserved